FEDS Protection Announces $3 Million Coverage Option

Federal managers asked, and we listened—FEDS Protection is excited to announce that we have added a $3 million civil liability coverage option to our professional liability insurance (PLI) program, extending civil liability coverage available for federal employees beyond the existing $1 million and $2 million policies.

Navigating COVID-19 Safety Practices as a Federal Manager

As the COVID-19 virus continues to spread across the United States, the federal government is instituting safety policies and imposing non-compliance-based discipline on its employees. For instance, as we have previously detailed, the Biden administration established a mask mandate across the federal government. Federal managers have now been tasked with enforcing these new safety protocols, including the mask mandate. Implementing these new practices have created unusual difficulties for federal managers.

FEDS Protection Joins CRC Group to Expand Coverage Options for Government Employees & Contractors

For 14 years, Federal Employee Defense Services has provided professional liability insurance (PLI) for federal managers and has been a proud advocate for the federal community. Now, FEDS is expanding its ability to offer even more support to federal employees, including managers, through its acquisition by CRC Group, a leading national wholesale distributor of specialty insurance products. This timely partnership will enable FEDS to expand coverage options for public employees and contractors.

Are You Ready To Manage Your Workforce on January 20?

On January 20, 2021, President-elect Joe Biden will be sworn in as the 46th President of the United States, and a new administration will assume the operation of the federal government. With the new administration, there will likely be significant changes directly impacting the lives and jobs of federal employees.

How Managers Can Learn About FEDS

Calling all federal managers! Are you prepared to defend yourself against allegations from your agency, disgruntled employees, or the public? Your everyday managerial duties leave you at risk of civil suits, administrative actions, and criminal investigations—FEDS Protection can help.

How PLI Can Help Protect Against Schedule F

On October 21, President Trump issued Executive Order 13957, which will reclassify workers "in positions of a confidential, policy-determining, policy-making, or policy-advocating character" into a new category, Schedule F. Schedule F employees will be exempt from the typical federal employment processes, making the positions easier to hire and fire. While the number of federal employees impacted by the Executive Order is unknown due to the elastic definition of what could be classified as Schedule F, the American Federation of Government Employees estimates that it could impact “perhaps hundreds of thousands” of federal employees.

Trick or Treat: Do You Know What to Expect With PLI?

No federal manager goes to work expecting to get sued or anticipates spending tens or even hundreds of thousands of dollars in legal fees to defend their career. However, today’s current political climate (with increased workforce challengers, Congressional investigations, and political pressures) means federal managers are increasingly vulnerable to civil lawsuits and administrative actions. If an allegation is made against you, are you aware of your rights as a federal manager? Are you prepared to vigorously defend yourself even if the allegation is baseless? Do you have professional liability insurance in place to help you in these trying matters? In the spirit of the fall season, FEDS Protection has put together a list of Trick or Treat facts that will help you learn more about your liability exposures and how best to protect yourself with FEDS PLI.

Looking Back & Looking Forward

The ongoing COVID-19 pandemic constitutes one of the greatest challenges this country has faced since the attacks of September 11th. This week marks the 19th anniversary of 9/11, and FEDS Protection continues to salute those federal employees who have continued to serve our country through crises past and present.

Why Federal Managers Need Professional Liability Insurance Now More Than Ever

The last few months have brought with them new challenges to federal managers and supervisors. In FEDS Protection’s latest webinar, FEDS President Tony Vergnetti discusses the civil, administrative, and criminal exposures of federal managers, with a focus on additional challenges presented by the ongoing COVID-19 pandemic. From quickly and effectively transitioning to teleworking, handling employee health and safety challenges, dealing with employee privacy concerns, and more, federal managers are at an increased risk of employee administrative complaints and agency investigations. Listen to this short webinar to learn how federal managers can protect themselves with FEDS Protection professional liability insurance.

Increased Challenges, Increased Exposures

As the United States enters its fourth month of COVID-19-related shutdown in some form, the long-term behavioral impacts of the ‘new normal’ are beginning to appear. Recent polls and official guidance indicate that Americans are experiencing elevated levels of unhappiness and anxiety due to the ongoing pandemic.

Why Do Federal Managers Need Professional Liability Insurance?

On June 4th FEDS President Tony Vergnetti was the featured guest on the FedUpward podcast, in an episode titled “Do you need professional liability insurance?”

Will Feds Face a Coronavirus Commission?

Lawmakers are already circulating proposals to investigate missteps and policy holes that led to the coronavirus outbreak in the U.S. Whether or not you’re employed by one of the 71 agencies responding directly to this crisis, you need to understand what your exposures are and how you may be impacted.

When Overwhelmed is an Understatement – Knowledge is Power

“I’m overwhelmed” has never been echoed by federal employees more than it is right now. And it’s not just CDC, FDA, and NIH employees. BOP, USDA, USPS, ICE, EPA and every other agency employee is calling FEDS Protection with questions regarding concern over decisions and actions/inactions in the performance of duties or managing work, programs, or employees.

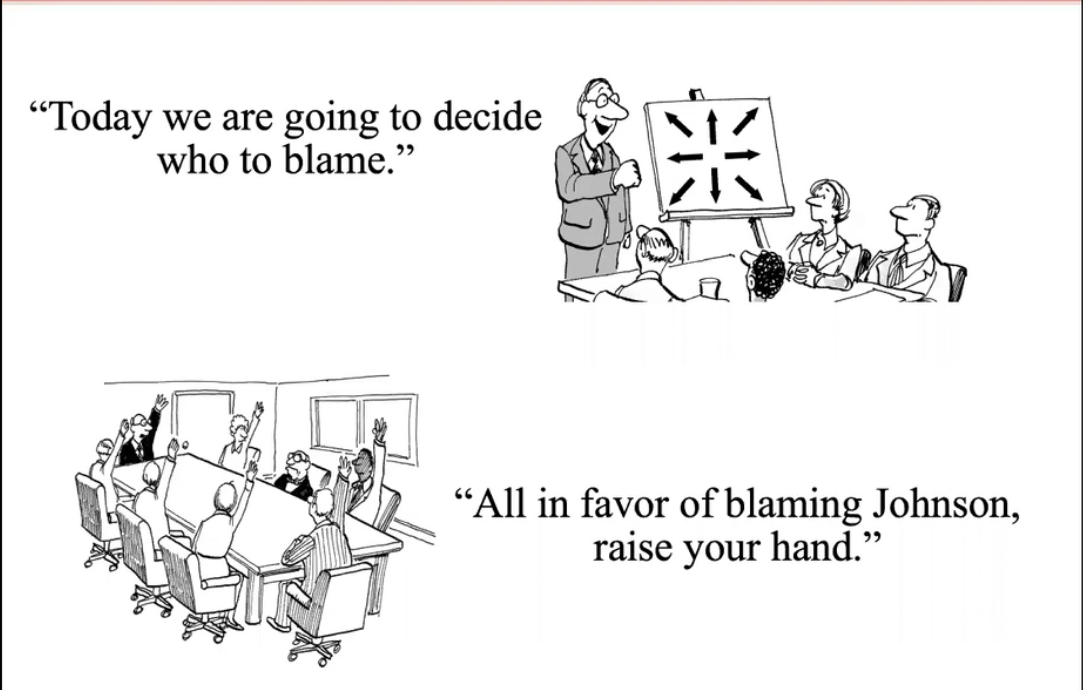

Today…Telework. Tomorrow…20/20 Hindsight, Allegations & Accountability

While the world is facing an unprecedented crisis, finger-pointing and allegations of “mismanagement” may begin. We know this because we’ve defended federal employees in other unprecedented crises, just in the last few decades, such as 9/11, Hurricane Katrina, Benghazi, Waco, Ruby Ridge, wildfire fatalities, etc.

Applying Successes of Private Entities in Today’s Federal Agencies

There is no sugarcoating the fact that we need to redesign agencies to address modern problems and take advantage of modern tools. Any leader effectuating change in a federal agency needs to carefully consider how to meet the mission of the agency and manage the expectations of the public while working within federal regulations and budgetary restrictions. This is no different than any corporate leader, right?

Extra! Extra!

These words used to signify breaking news that was urgent and significant. Now, up to the minute news is available around the clock and almost all news segments and stories are sensationalized. Fake news? Real news? It doesn’t matter – ratings do. News today is all about reporting on current events in a shocking, scandalous or appalling manner to increase or hold viewer or readership. And unfortunately, for today’s Feds, if there is a newsworthy event involving a federal employee or agency, it’s also a crisis, scandal or controversy.

Federal Manager Allegations Are Unsettling

For federal managers, ignorance is expensive. Know your exposures and the protections available to you.

Federal Whistleblowers – A Partnership To Protect

FEDS Protection and the Whistleblowers of America are proud to announce a new partnership to educate the federal community about whistleblowing.